Health Savings Accounts (HSAs) can be used to pay for telehealth, leveraging the power of these vehicles to ease the sting of rising out-of-pocket costs that make healthcare unaffordable. But there’s an even more effective way to leverage employer-provided benefit allowances. Employers are starting to adopt Health Reimbursement Arrangements (HRA) in conjunction with a high-deductible health plan (HDHP) called a Post-Deductible HRA.

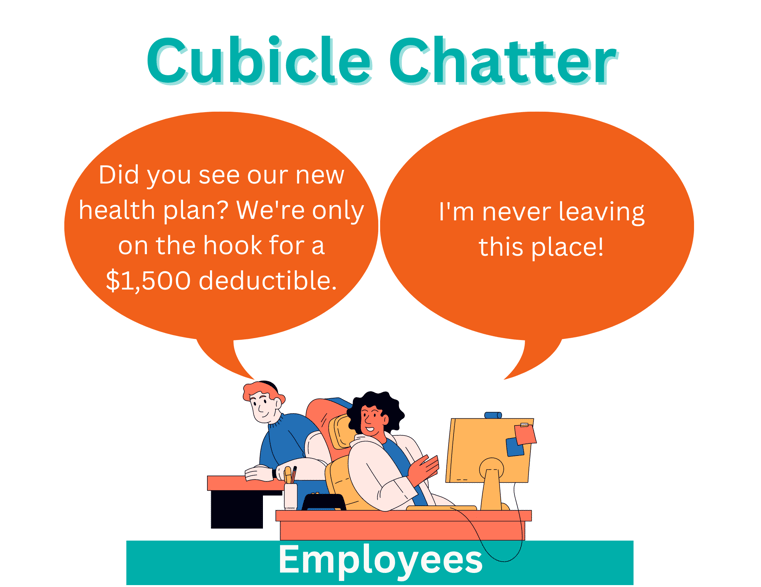

This innovative approach in effect resets the annual deductible to $1,500 from a very high out-of-pocket maximum of $7,500 for individual insurance coverage, thus bridging the large gap. All claims exceeding $1,500 would be paid from the $6,000 employer-funded HRA, though that allowance is simply a suggestion that will vary from one organization to another. The same formula could apply to dependents, with a $15,000 deductible for family coverage reset to $3,000 with $12,000 from the HRA.

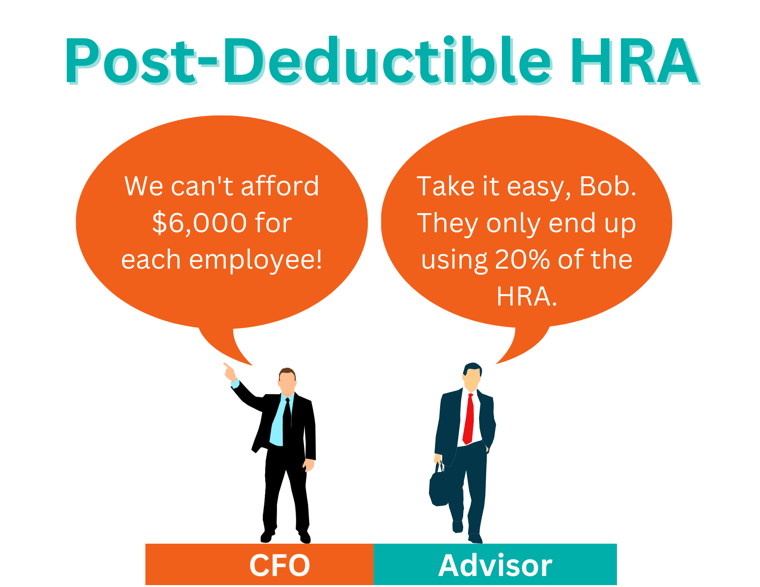

Since EZaccessMD's business model significantly reduces unnecessary and costly trips to the ER or in-person urgent care, combining the Post-Deductible HRA with EZaccessMD as the triage point packs a powerful punch. Under this arrangement, health plan members are less likely to exceed their deductible and tap the HRA funds that have been set aside. Historically, HRA penetration has been only 40% of the reserved funds. With EZaccessMD embedded in the plan and mitigating claims in the deductible space, we expect 20% or less penetration of the HRA.

One of EZaccessMD’s Post-Deductible HRA clients actually went from a 37% HRA penetration to just 11% after implementing this arrangement. So for a fraction of the potential HRA exposure, they were able to give their employees a rich combination of benefits: in-home healthcare combined with a no co-pay medical plan. EZ's clients pay an average of $144 a year per employee, which turns out to be a very wise investment when it’s baked into those plans to leverage the employer spend. Combining EZaccessMD with a Post-Deductible HRA in this way gives the employee a gold plated plan at a very modest cost to the employer.

What about health Flexible Spending Accounts? These too can be offered in conjunction with the Post-Deductible HRA, making even more options available for employees. If this sounds like it might be confusing to your employees, remember that the Post-Deductible HRA will be invisible to them, it can be handled in the background by your TPA. The employee just sees that their employer is now offering a much richer plan without any additional employee contribution.

The Bottom Line? A Post-Deductible HRA used with EZaccessMD’s mobile urgent care service is a great approach that can increase consumerism and create a balance between claims utilization, out-of-pocket responsibility and employer funding in a well designed health plan. All together healthcare will become much more affordable and accessible, and your employees will see a workplace that offers generous benefits.

To learn more about EZaccessMD, chat with a consultant here: